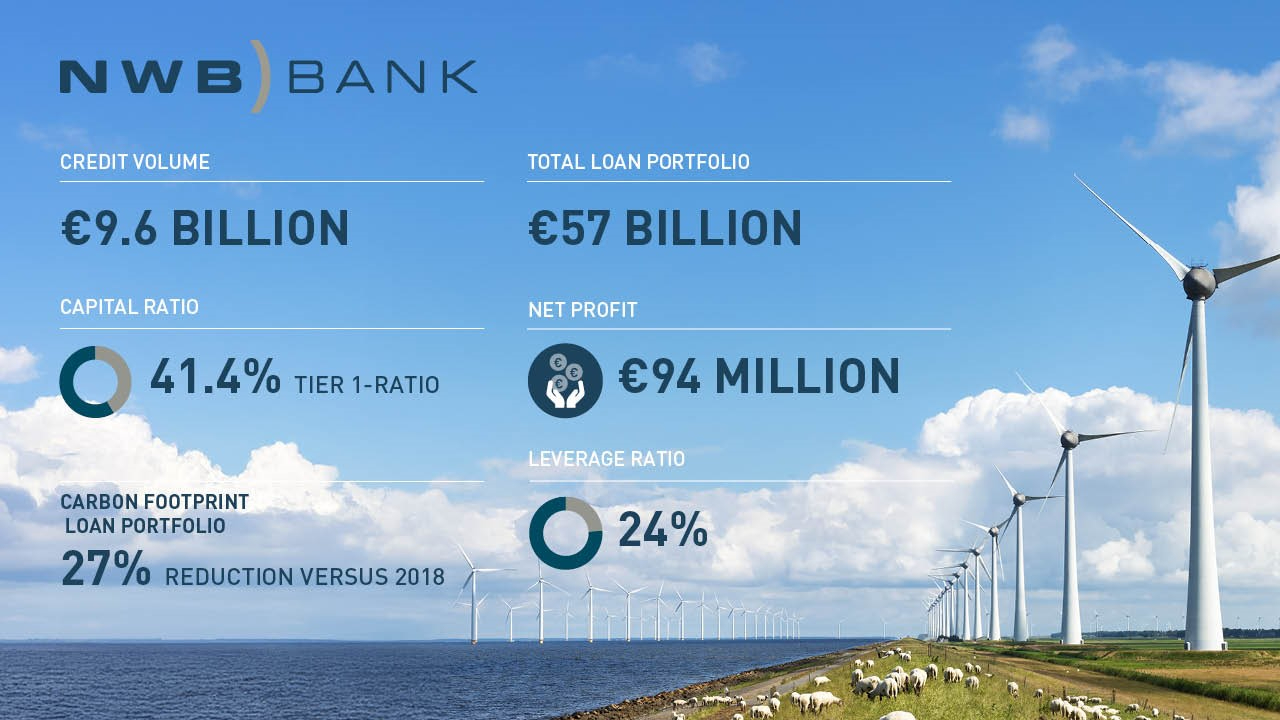

NWB Bank finances growing public sector investment needs

- New lending to public sector up 30% to €9.6 billion

- Loan portfolio reaches record level of €57 billion

- Net profit of €94 million

- 2024 Sustainability Statements already aligned with CSRD guidelines

The Hague, 19 March 2025

NWB Bank provided significantly more loans in 2024 than in the previous year, according to its annual report. New lending to public sector clients in the Netherlands increased by 30% last year to €9.6 billion (up from €7.4 billion in 2023). The loan portfolio reached a record size of €57 billion. Despite the increase, the climate footprint of this financing continued to decrease. The net profit for 2024 was €94 million. €50 million will be distributed as dividends to shareholders: water authorities, the Dutch state and several provinces.

Chair of the Managing Board Lidwin van Velden: ‘We see our clients’ investment needs increasing and expect further growth in the coming years. This is due to the important transition challenges we face in the Netherlands. Our clients need to invest significantly in areas such as climate adaptation, water quality and social housing. Investment is also needed in sustainable energy and the circular economy. As a bank of and for the public sector, we have once again demonstrated our commitment to providing our clients with appropriate financing at the lowest possible cost.’

In 2024, NWB Bank contributed to important societal projects that will help make the Netherlands future-proof. For example, as part of the Flood Protection Programme, financing for dike improvements helped strengthen flood resilience. In the social housing sector, the bank has supported sustainable renovations, such as those carried out by the Domijn housing association, which is committed to bio-based insulation. NWB Bank also plays a role in the healthcare sector, where it financed the renovation and digitalisation of the Maastricht UMC+. The bank also supports the transition to sustainable energy, including financing an innovative sewage sludge processing plant for the HVC Group. This plant will provide sustainable heating to thousands of households.

Healthy figures

NWB Bank posted a healthy profit of €94 million in 2024 (compared to €126 million in 2023; the 2023 profit was exceptionally high due to one-off windfall gains in the result from financial transactions). The bank’s capital and liquidity buffers remain strong. The Tier 1 capital ratio was 41.4% and the leverage ratio was 24% on 31 December 2024. Both are well above the minimum standards of 14.7% and 3% respectively. The liquidity coverage ratio (LCR) and the Net Stable Funding Ratio (NSFR) are also well above the minimum requirement of 100%, at 183% and 134% respectively.

Transparency about impact

Since 2018, the climate footprint of NWB Bank’s loan portfolio has decreased by almost 22% per euro financed. Therefore, the bank is on track to meet the targets set out in the ESG Transition Plan published last year. This plan, which follows the 2022 Climate Action Plan, expands beyond climate targets to include social impact and biodiversity goals. Transparency about impact is a top priority for NWB Bank. As a result, the bank has already applied Corporate Sustainability Reporting Directive (CSRD) standards to its 2024 sustainability reporting, one year ahead of its obligation 1.

1 Please note that the European Commission has proposed to change the CSRD.