Successful EUR 1 billion 3-year benchmark issuance completed for financing public sector

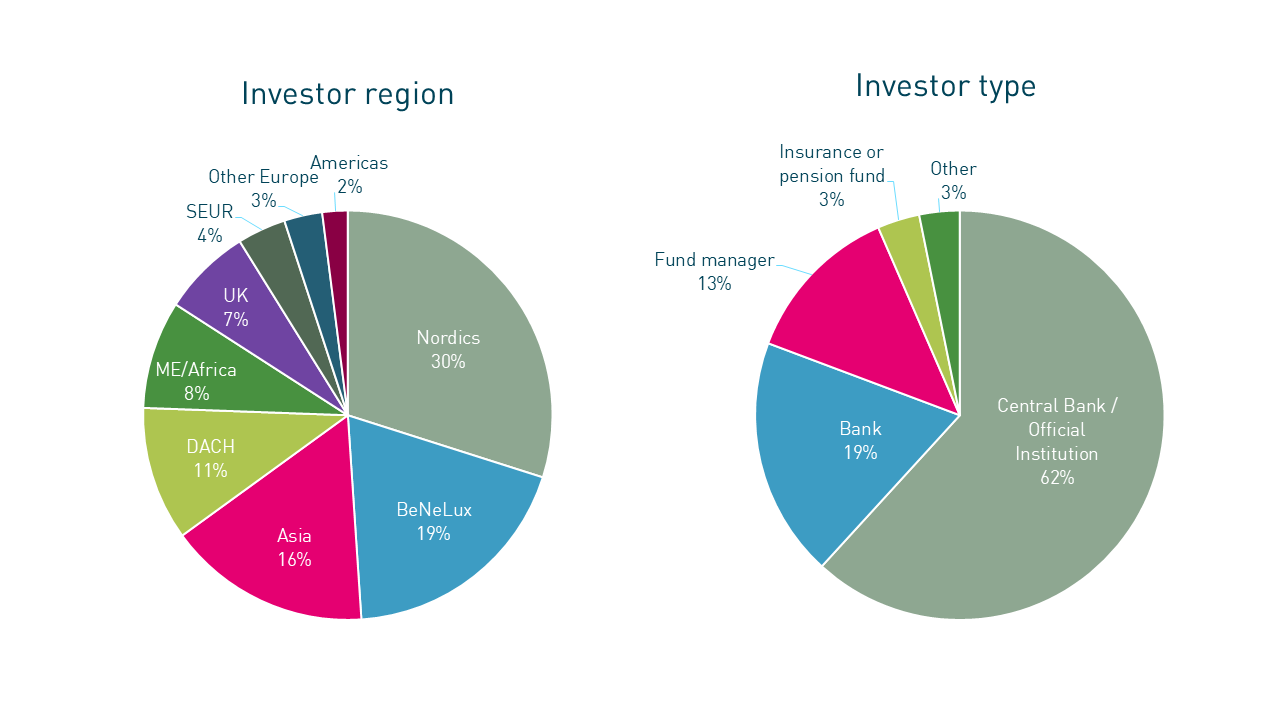

We successfully issued a €1 billion 3-year benchmark bond on Thursday, October 23 2025. The issuance was received with great enthusiasm, resulting in oversubscribed demand of nearly € 2 billion and demonstrating the robust support of our Euro investor base.

The proceeds of the bond will directly benefit the financing needs of the Dutch public sector. This transaction brings us one step closer to achieving our total financing target of €11-13 billion for 2025, of which approximately 95% has already been achieved.

|

Transaction summary: |

|

|

Borrower |

NEDERLANDSE WATERSCHAPSBANK N.V. (“NWB Bank”) |

|

Ratings |

Aaa Stable (Moody’s) / AAA Stable (S&P) |

|

Format |

RegS, Bearer |

|

Coupon |

2.125%, Fixed, Annual, Act/Act |

|

Size |

EUR 1 billion |

|

Payment Date |

30th October 2025 |

|

Maturity Date |

30th October 2028 |

|

Reoffer Spread |

MS+ 8 bp |

|

Reoffer Price / Yield |

99.736% / 2.217% |

|

Denomination |

EUR 100,000 / EUR 1,000 |

|

Listing |

Luxembourg Stock Exchange |

|

Joint Lead Managers |

BNP Paribas, HSBC, ING, and Morgan Stanley |

|

ISIN |

XS3219429621 |

"This transaction is clear evidence of the trust that a diverse, international investor base has placed in us. It's a fantastic achievement to attract nearly 50 high-quality investors. Best of all, this successful benchmark directly contributes to favorable financing conditions for the Dutch public sector. That’s what motivates me!"